Nat’s story – “Being a young carer can be lonely”

Nat reflects on her experience of being a young carer and the support she received from the Nationwide dementia clinic.

Many people with dementia and those who live with them qualify for a Council Tax reduction or exemption that could be worth hundreds of pounds every year. Our dementia specialist Admiral Nurses explain what you need to know about Council Tax discounts for people with dementia and how to apply if you are eligible.

People who are classed as ‘severely mentally impaired’, which includes many people with dementia, may be eligible for a reduction in their Council Tax. The discount varies from 25% to 100% and is available in England, Scotland and Wales.

Council Tax is a local council charge for providing services such as refuse collection, parks and recreation areas, street cleaning, local planning, parking enforcement, and tackling nuisance crimes like fly-tipping. The amount depends on which ‘valuation band’ your home is in.

Severe mental impairment is defined as, ‘a severe impairment of intelligence and social functioning which appears to be permanent’. This means that while people with dementia are likely to qualify for the discount, it depends on how significantly it affects them.

The term ‘severely mentally impaired’ can be upsetting and offensive to many people with dementia and their families. At Dementia UK, we recognise that it may cause distress and do not advocate its use. However, this is the official term used by the Government and local councils.

A person with dementia who is classed as ‘severely mentally impaired’ will qualify for a 100% discount on Council Tax (in other words, they will pay nothing) if:

Simply being a carer for someone you live with doesn’t qualify you for a Council Tax discount. However, if the person you live with and care for is considered ‘severely mentally impaired’, you will get a 25% ‘single person’s discount’ as long as:

The amount of potential discount on a council tax bill will depend on a range of factors, including how many people live in the residence, if they meet other eligibility criteria and proof of dementia diagnosis.

A person with dementia who is ‘severely mentally impaired’ will qualify for a 100% discount on Council Tax – in other words, they will be exempt – if they live alone, or if any other adults in the home are:

There will be a 50% Council Tax if any other adults the person with dementia lives with are ‘disregarded’. People who are ‘disregarded’ include those who are:

If you live with someone with dementia who qualifies for a Council Tax discount, you will receive a 25% discount if:

You will need to contact your local council directly for details of whether you qualify for Council Tax discount and how to apply. You can find more information on the Government’s website.

To prove that the person’s dementia has a significant effect on how they function, they will need a letter from their doctor. They will also need to prove to their local council that they receive certain other benefits – this varies between areas, and you will need to contact your council to find out which benefits count.

A Council Tax reduction in England, Scotland and Wales for a person who lives in a property that is bigger than they would need if they or someone they live with were not disabled.

You will need to prove that the home is the primary home of at least one disabled person, and that they have either:

People with dementia may be eligible for the reduction if you can demonstrate that the adaptation is necessary for their needs (for example if they have mobility problems that mean they can’t use the stairs, and so an additional downstairs bathroom is needed).

If you qualify, your Council Tax band will be reduced to the next lowest band – so if, for example, your property is in band C, you will pay the rate of a band B property. If your home is already in band A (the lowest band) you will get a 17% discount.

You will need to apply directly to your local council. An assessor may need to visit your home to check your eligibility.

A similar benefit to the Council Tax Disabled Band Reduction Scheme in England, Scotland and Wales, called the Disabled Person’s Allowance, is available in Northern Ireland.

Disabled Person’s Allowance is available to people who have, or live with someone who has, a disability, and whose property has been adapted internally or has additional features to support the disabled person’s needs. The adaptation could be:

There must be a clear link between how the property has been adapted and the person’s disability. Rearranging rooms in the property is unlikely to qualify for the reduction (eg turning a ground floor room into a bedroom).

Disabled Person’s Allowance provides a 25% discount on rates (the equivalent to Council Tax in Northern Ireland).

Download a claim form, or if you cannot do this, call 0300 200 7801 or email applicationbased.raterelief@finance-ni.gov.uk to request a form. You will need to include information about the person’s disability, along with any supporting medical evidence, and details of the adaptations made to your home.

The person with the disability will need to consent to their GP or other medical professional being contacted for information and may need a home visit from a member of the Disabled Persons Allowance Team.

This is a reduction in rates in Northern Ireland for people over 70 who live alone. People can be awarded the benefit alongside the Disabled Person’s Allowance on rates.

People who do not live alone may also be eligible if they:

If the person qualifies, their rates will be reduced by 20%.

If you are a homeowner, you can download a claim form, or if you cannot do this, call 0300 200 7801 or email applicationbased.raterelief@finance-ni.gov.uk to request a form.

If you live in a rental property, you can apply online through the Northern Ireland Housing Executive or call 03448 920 902.

You will need to include information about the person’s disability, along with any supporting medical evidence, and details of the adaptations made to your home.

The person with the disability will need to consent to their GP or other medical professional being contacted for information and may need a home visit from a member of the Disabled Persons Allowance Team.

If your application is refused, you can write to your local council and tell them why you think the decision is wrong. They will then decide whether the bill is either:

You need to carry on paying the amounts listed in the original bill until the new bill arrives. It’s important to note that the council has two months to reply to you.

If it’s decided that the person with dementia doesn’t qualify for Council Tax discount and you disagree, you can challenge the decision by appealing to the Valuation Tribunal.

While it is a free service, you have to pay for your own costs (for example, fees for paying for a medical report as evidence).

Make sure you appeal within two months of the council telling you their decision or four months of you first writing to the council if you haven’t had a response. Late appeals may be accepted in special circumstances beyond your control.

If the tribunal sides with you, the council will update your bill.

To speak to a dementia specialist Admiral Nurse about benefits or any other aspect of dementia, call our free Dementia Helpline on 0800 888 6678 (Monday-Friday 9am-9pm, Saturday and Sunday 9am-5pm, every day except 25th December) or email helpline@dementiauk.org.

If you prefer, you can pre-book a phone or video call appointment with an Admiral Nurse.

Finance and young onset dementia

Financial and legal sources of support

Government information on Council Tax (England, Scotland and Wales)

Guide to rates (Northern Ireland)

entitledto benefits calculator

Worried about the financial impact of a dementia diagnosis? From benefits to care costs, our Admiral Nurses can help you plan ahead and understand your options.

Nat reflects on her experience of being a young carer and the support she received from the Nationwide dementia clinic.

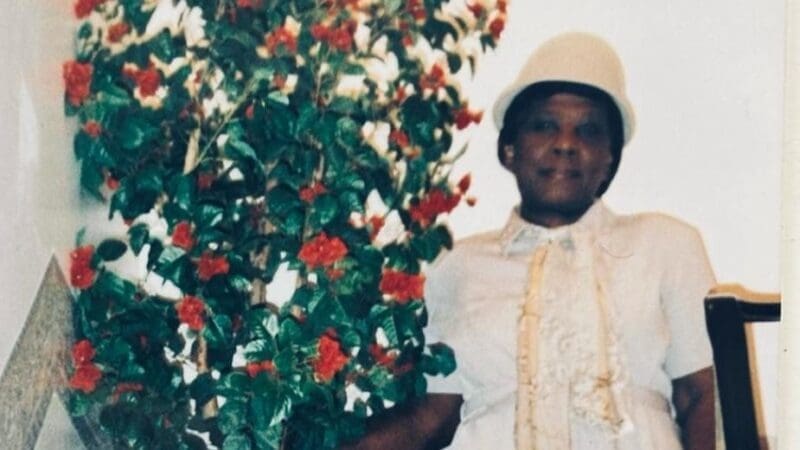

Tim reflects on the stigma that is often attached to dementia and the importance of the Black, African and Caribbean Admiral Nurse clinics.

Katrina reflects on the support she has received from her Admiral Nurse, Rachel, since her husband was diagnosed with young onset dementia.

A person who lives alone and is classed as ‘severely mentally impaired’ will qualify for a 100% Council Tax discount. If they live alone but are not considered ‘severely mentally impaired’, they may receive a 25% discount on their Council Tax. To check if you are eligible, contact your local council.

While Council Tax discount is classed as a benefit, it will not impact other benefits you will receive.

If you are experiencing issues with a GP refusing to provide evidence and speaking with them hasn’t resolved the issue, you can ask to speak to the Practice Manager about your concerns.